Biblically Responsible Investments for Donor Advised Funds

Every Dollar

has a Purpose

When you open a donor advised fund with The Signatry, your donations can start making a difference even before you recommend grants to your favorite charities. You can recommend that the dollars in the fund be placed in one (or more) of our biblically responsible investment (BRI) pools. Each investment pool is comprised of businesses screened for sustainable, ethical, biblically responsible business practices.

See how our investment pools performed in the most recent quarter:

Charitable Investments Aligned with Your Goals and Passions

As a donor, you would never give to a cause you did not believe in. So why would you invest in one?

What is your cause? Whether you are passionate about orphan care, health care, or something different, we have investment pools dedicated to supporting the companies and organizations making an impact for these causes. As a faith-based investor, you can evaluate the level of risk and growth metrics, then recommend investing in one pool or a combination.

Biblically Responsible Investing and Stewardship

Filtering for companies that value ethical, responsible business practices does not come at the expense of investment performance. Faith-based and other ethical investment pools like ours tend to yield comparable returns to other similar investment options.

“We should expect that investing in businesses that work in harmony with God’s design will be the best investment strategy for meeting our clients’ needs. And that is exactly what we find.”

Jason Myhre, Executive Director, Eventide Center for Faith & Investing

Managed Pools

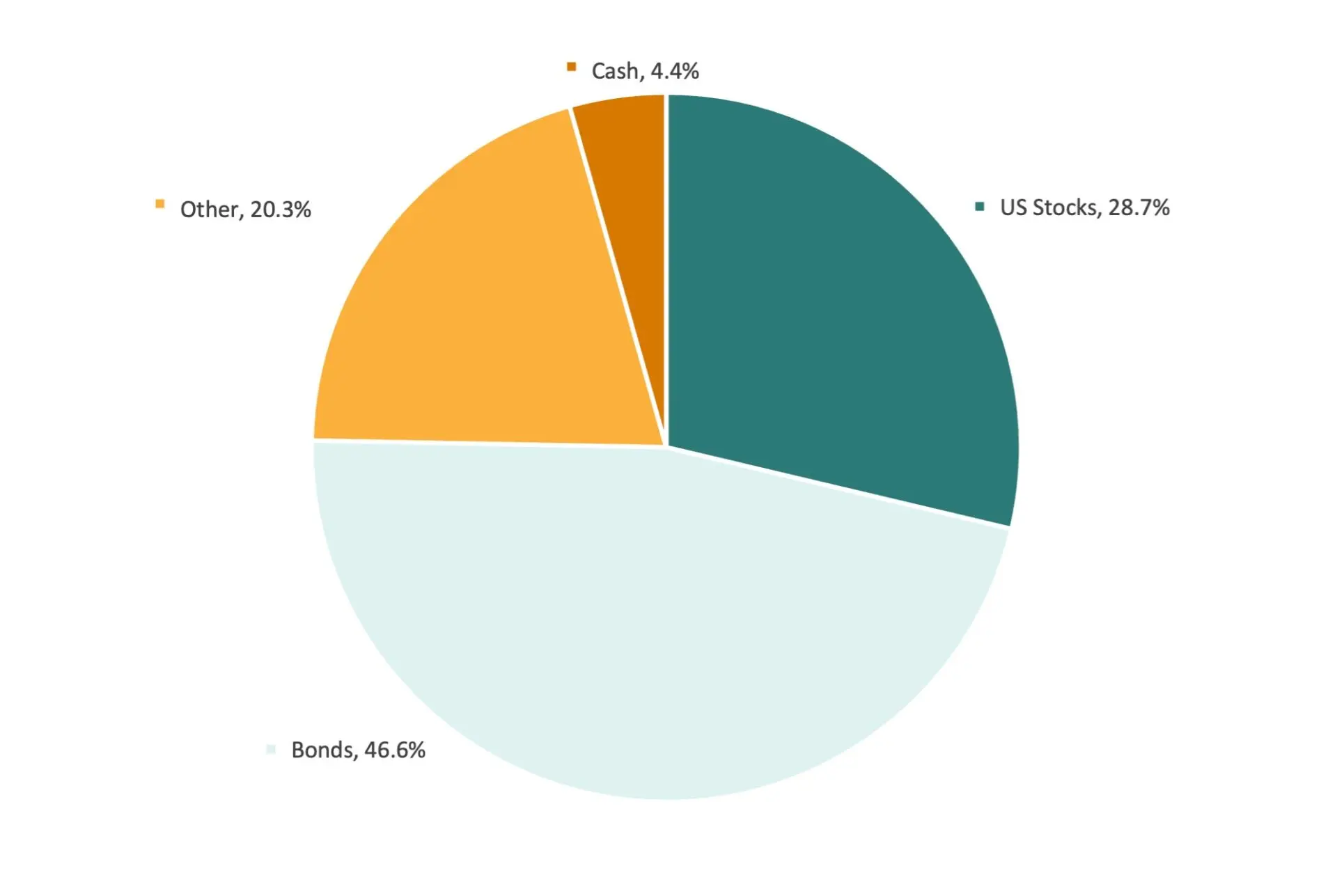

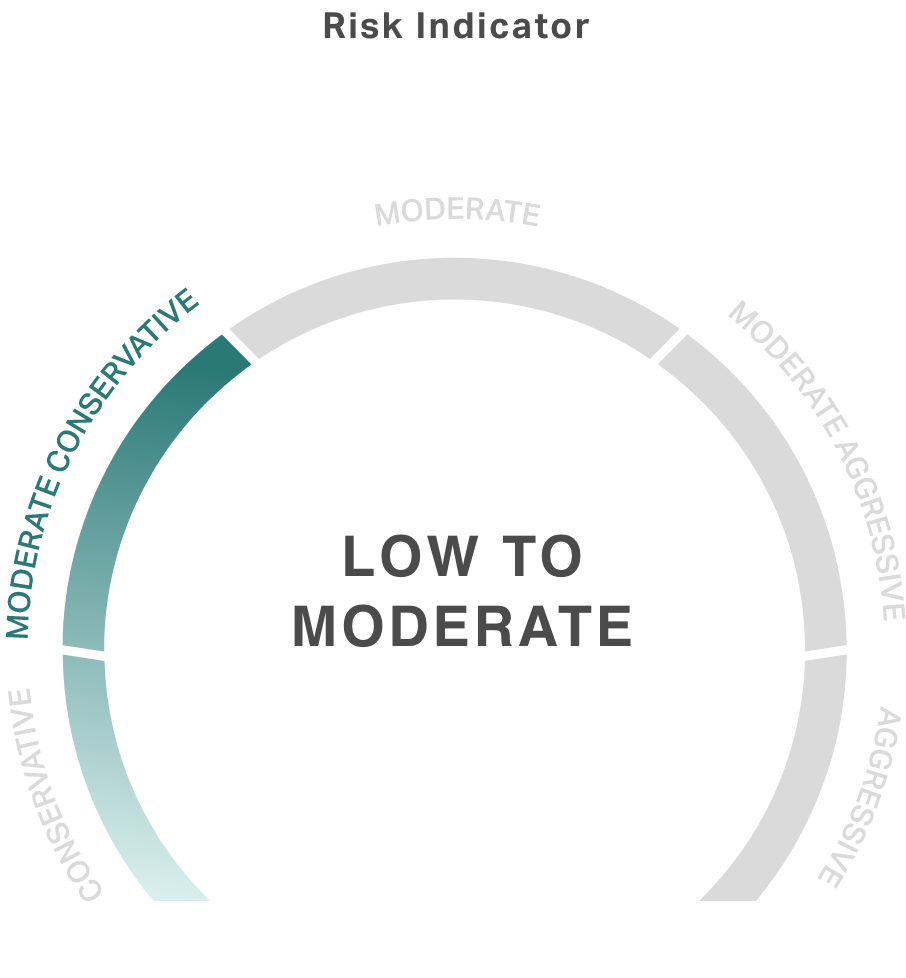

Conservative Allocation Pool

The Conservative Allocation Pool is a diversified pool that pursues slightly higher capital appreciation through a 30 percent allocation of equity, with the remaining assets allocated in fixed income. This pool has low to moderate risk.

This pool has a target allocation of:

Fixed Income

45% CWC Fixed Income

Alternatives

20% CWC Alternatives

Equity

15% CWC Large Cap Value

15% CWC Large Cap Growth

Money Market (5%)

Management Fees: 35 basis points (0.35%)

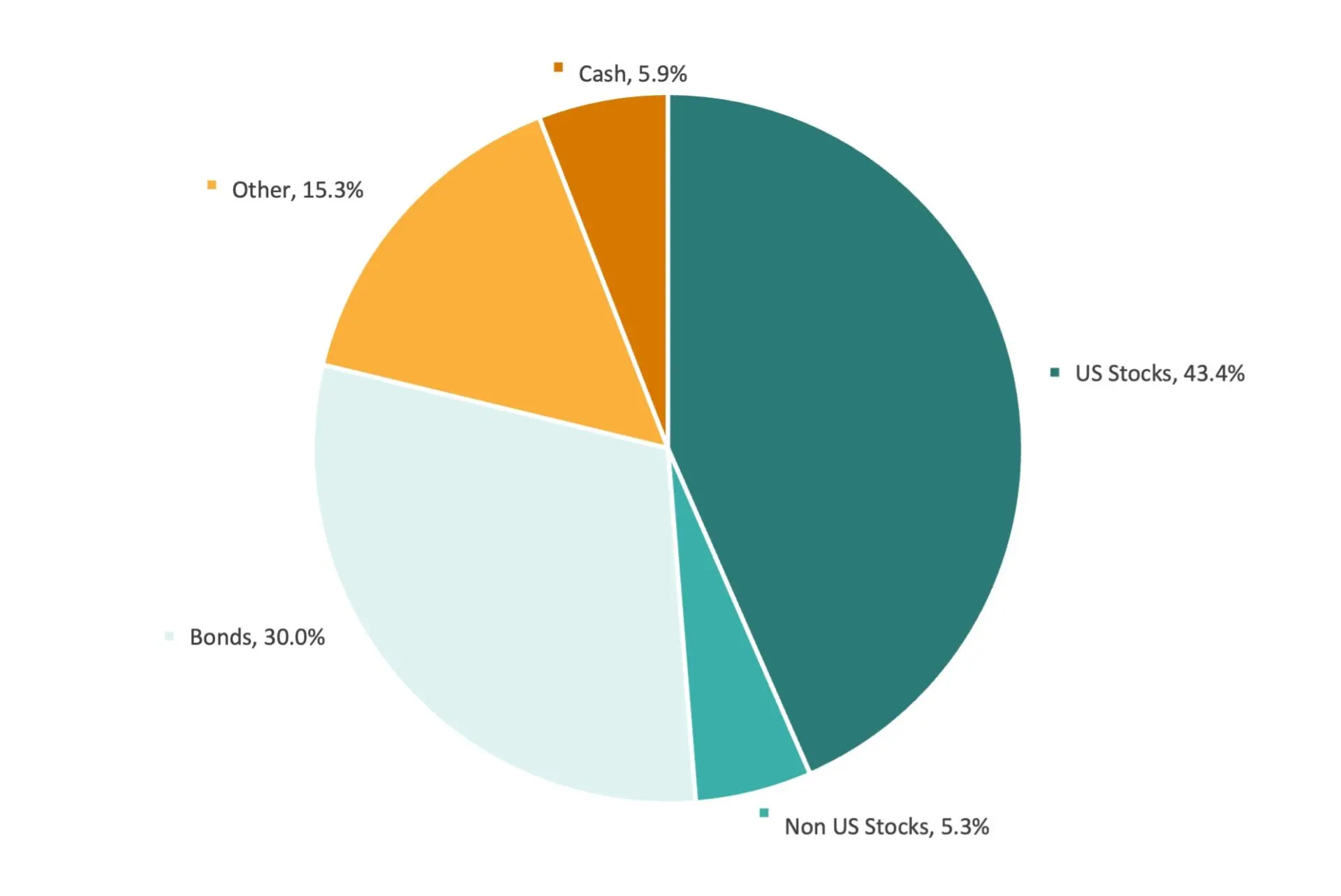

Moderate Allocation Pool

The Moderate Allocation Pool is a diversified pool that pursues a balance between income and capital appreciation by having equal percentages of assets allocated to both fixed income and equity. This pool’s risk level is moderate to moderately aggressive, and it seeks current income while maintaining the potential for long term capital appreciation. Balancing exposure to global stocks and bonds helps to moderate return volatility.

This pool has a target allocation of:

Fixed Income

30% CWC Fixed Income

Alternatives

15% CWC Alternatives

Equity

20% CWC Large Cap Value

20% CWC Large Cap Growth

5% CWC Small Cap

5% CWC International

Money Market (5%)

Management Fees: 75 basis points (0.75%)

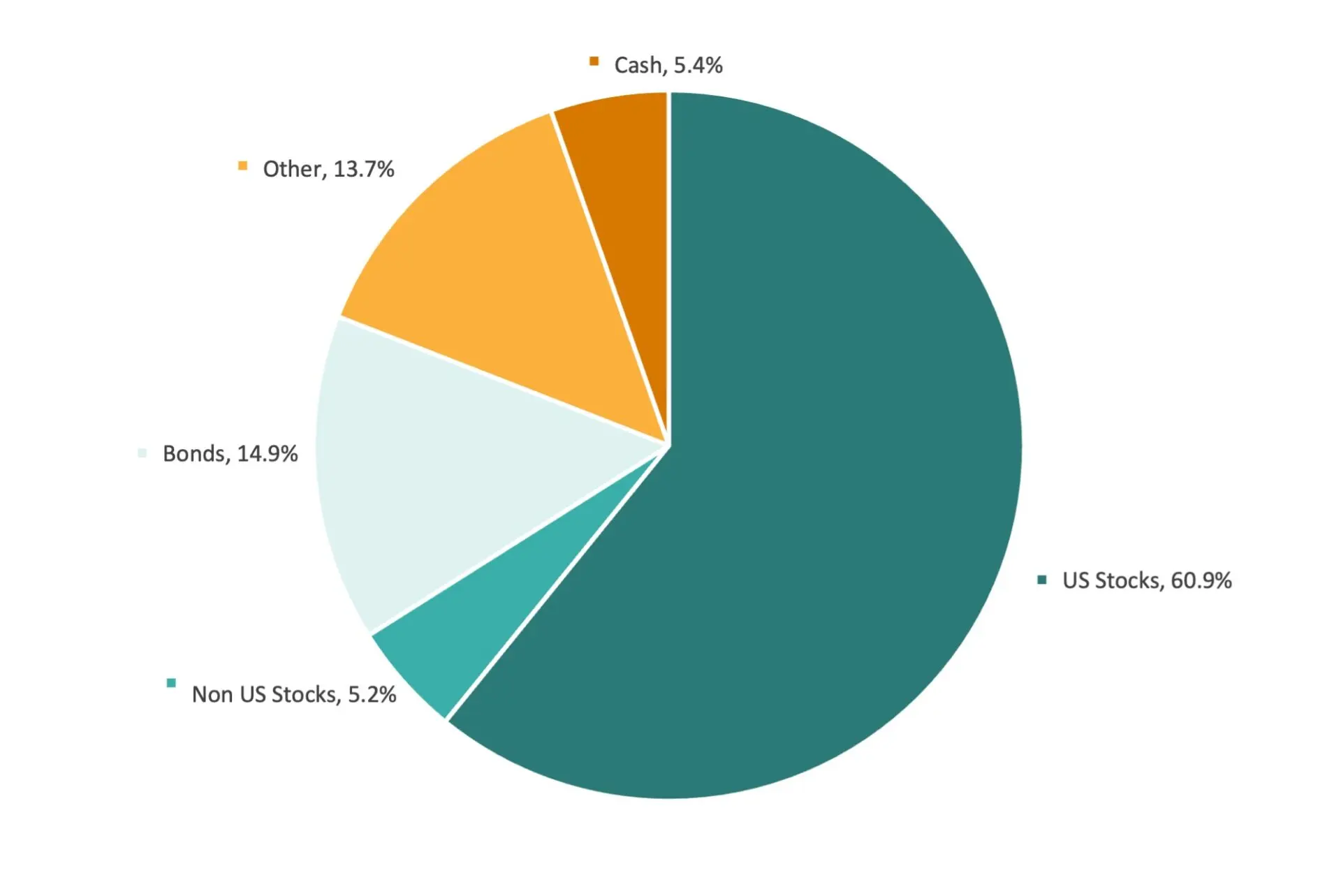

Aggressive Allocation Pool

The Aggressive Allocation Pool is a diversified pool that is primarily invested for growth, with 75 percent of assets invested in equity, and a moderate allocation to fixed income. This pool’s risk level is moderately aggressive to aggressive, and it seeks long term growth through a global allocation to stocks and bonds.

This pool has a target allocation of:

Fixed Income

15% CWC Fixed Income

Alternatives

10% CWC Alternatives

Equity

30% CWC Large Cap Value

25% CWC Large Cap Growth

10% CWC Small Cap

5% CWC International

Money Market (5%)

Management Fees: 75 basis points (0.75%)

Money Market

Money Market Pool

The Money Market pool is allocated to various cash and money market investments characterized by their short maturities and minimal credit risk. The Money Market pool generally has the lowest level of risk.

Money Market (100%)

Money Market (100%)

Management Fees: None. We employ financial-industry-accepted best practices of sharing growth in our money market pool earnings with our donor advised funds.

What is a

Donor Advised Fund?

Learn more about donor advised funds and

maximize the dollars that are sent out to build God’s kingdom.