Donor advised funds (DAFs) are certainly not new on the charitable giving “scene,” but their immense growth over the last 10 years has invited a lot of questions about how and why to use a donor advised fund, who uses these accounts, and where the money ends up. These are all valuable questions to pursue. The answers can provide donors, lawmakers, and other nonprofit leaders insight into how DAFs can work best for donors and for the charities these dollars support.

New research from the DAF Research Collaborative seeks to answer some of these questions. Researchers Danielle Vance-McMullen and Dan Heist studied account-level data from 13,000 DAF accounts from 21 different DAF sponsors (16 community foundations, 5 religiously-affiliated organizations, and—notably—no commercially-affiliated organizations).

The short version? How and why donors use DAFs is as varied and complex as are the donors themselves.

Donor advised funds vary widely in size

One common misconception about DAFs is that they only serve the superrich who want to donate huge sums of money all at once.

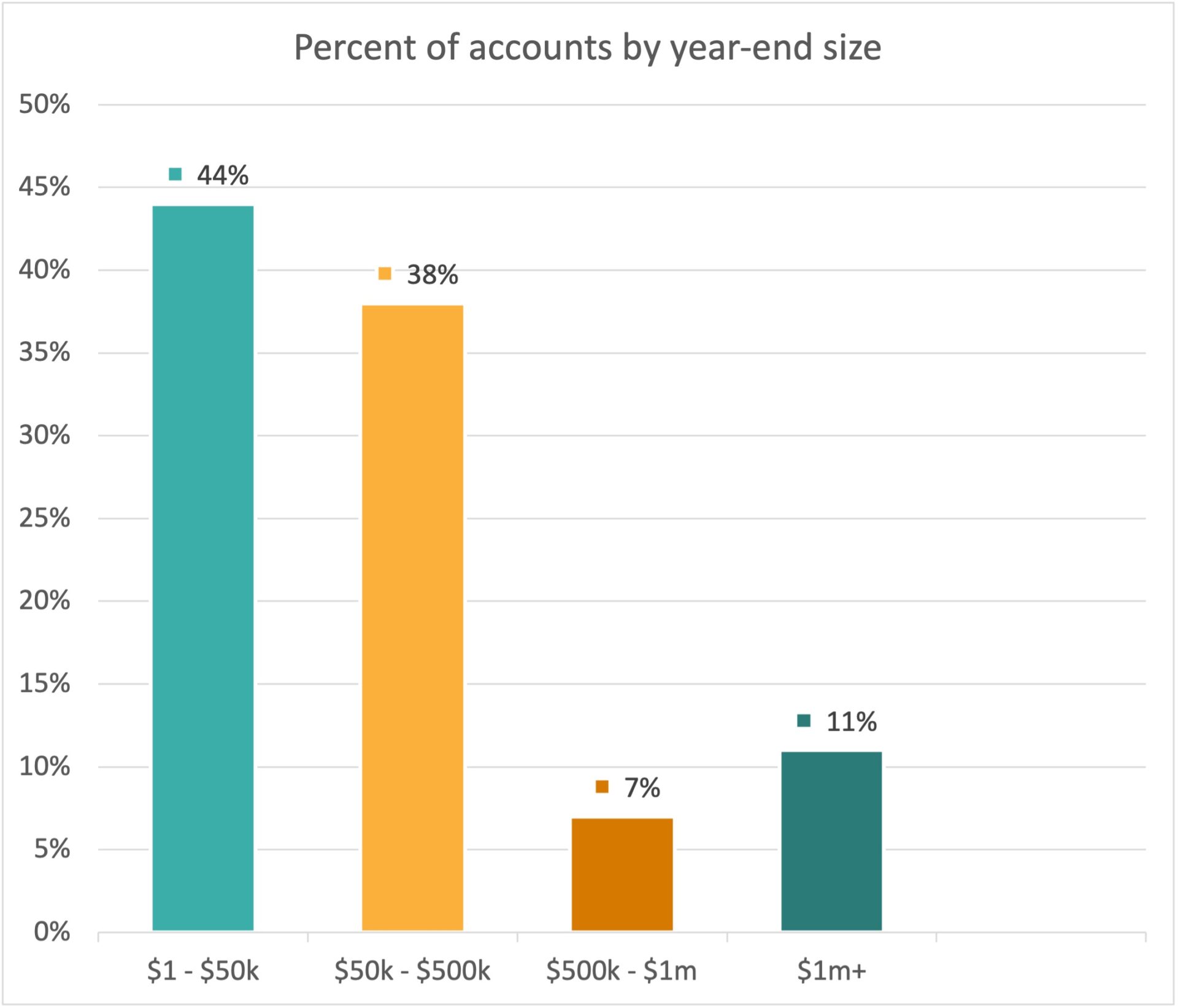

However, only 11% of the funds studied had over $1 million in assets. Nearly half (44%) held between $1 and $50,000. And more than half of contributions into these DAFs (54%) were less than $50,000 each.

Of course, to be able to donate $50,000 to charity is a significant financial privilege. But in comparison donors who want to start a foundation are generally advised to start with at least $500,000. Donor advised funds have a much lower barrier to entry, and we find it encouraging that families of more modest means who wish to maximize their charitable dollars have access to a tool that allows them to do so.

Donors use DAFs for a variety of giving strategies

One of the major reasons to use a donor advised fund is the flexibility it provides for each donor’s generosity goals. A donor may make regular contributions to a DAF, or they may make one large contribution as part of a major financial event like selling a business or piece of real estate. Similarly, they may recommend grants to nonprofits on a regular basis, or they may allow the fund balance to be invested and grow to prepare for a large gift in the future.

Given this, it is not surprising to find many different giving patterns in the data.

Between 2017 and 2020, 68% of the funds studied received at least one contribution. About 18% received at least annual contributions, and the rest fell somewhere in between.

Over the same period, 86% of funds made at least one grant to another nonprofit organization. This means that some donors who did not make any new contributions after 2017 still actively recommended grants to other charities with their existing fund balance.

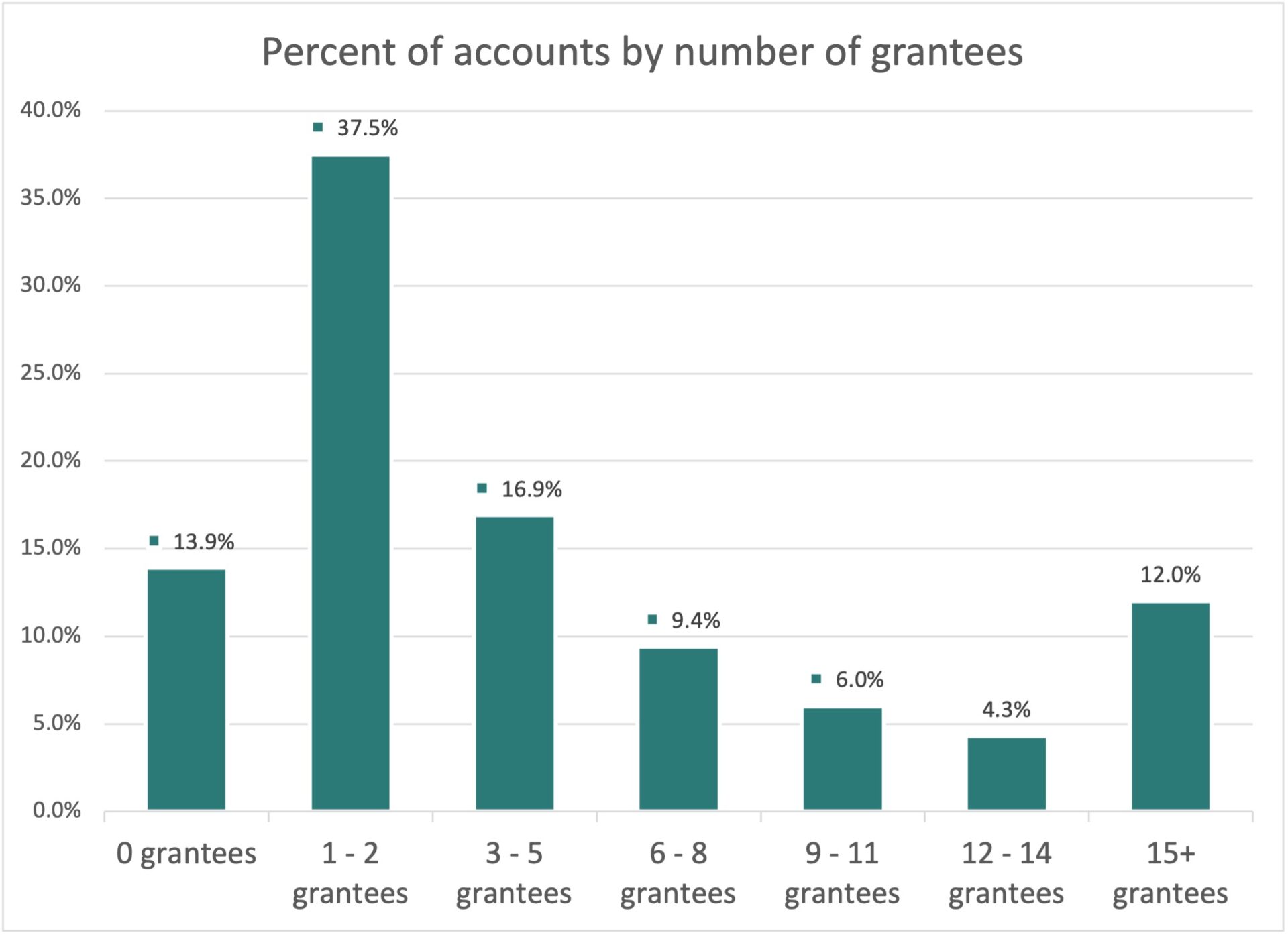

Donors also demonstrated different preferences about how widely to disperse grants. Some (about 38%) funds sent grants to between 1 and 3 organizations each year. But even more (nearly 50%) sent grants to more than 3 organizations each year—sometimes up to 20 grantees in a single year.

The breadth of giving activity represented emphasizes just how flexible DAFs can be to fit many different giving strategies.

DAF donors are responsive to expressed needs

Some critics worry that donor advised funds may “compete” with other nonprofit organizations that provide direct relief or services to those in need. However, patterns in DAF grantmaking over the course of a year suggest that donors are in tune with real-time, on-the-ground needs.

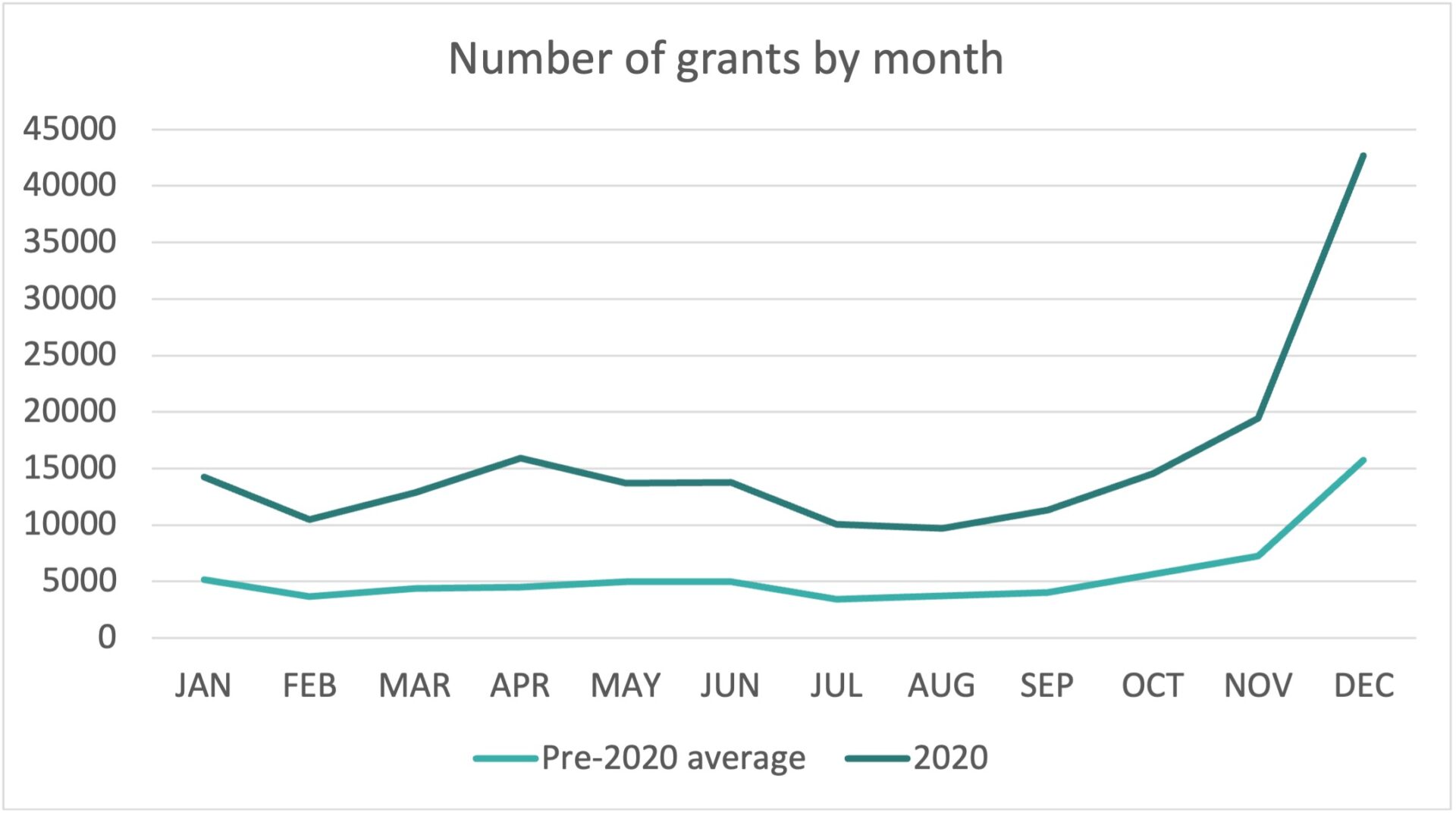

Unsurprisingly, most grantmaking (about 25% of all grants) occurred in December. Because donors to a DAF have already received any possible tax benefits from their contributions, the December spike in grants flowing out could be due to end-of-year fundraising requests from other charities. Donors are likely paying attention to the needs around them and responding accordingly.

DAF users are also more likely to recommend general operating grants than restricted grants. Unlike program-specific restricted grants, general operating grants give nonprofits more flexibility to invest in growth and support their leadership and staff. In 2018, only 20% of all nonprofit funding in the U.S. was “unrestricted.” But among the donor advised funds studied here, 64% of grants (representing 46% of dollars) were for general operating expenses. These dollars could flow to wherever nonprofits needed them most.

A significant spike in grantmaking in April 2020 also suggests a high responsiveness to crisis among DAF donors. At the beginning of the COVID-19 pandemic, donors recommended more than twice the number of grants than they did the previous spring. Grantmaking stayed above average throughout the year, and the “December spike” still occurred. DAF donors did not just change the timing of their charitable giving; they gave more in response to the pandemic.

All this is not the same picture we see painted, from time to time, by critics who worry that donor advised funds simply serve as places for celebrities and tech billionaires to park money for a tax deduction. A wide variety of donors use DAFs to achieve many different giving goals, from annual support of several cherished nonprofits to large, one-time gifts in response to particular needs.

The Signatry’s community, which grants dollars out at more than twice the rate of the industry average, reflects a similar diversity as was found in the study. Some of our donors use a donor advised fund to provide regular support to their favorite charities over time; others intend to give generationally and build a fund for their children or grandchildren to use in the future; and still others make substantial, one-time gifts as needed. Every expression of generosity is worth celebrating as we work together to solve the world’s greatest problems.

Looking for more information on donor advised funds?

How do DAFs work? What are some of the potential benefits? What else do you need to know? Check out our explainer to find out the details.

Learn MoreStart your journey towards a lasting legacy

Bring your family together around shared values and goals for generosity through a donor advised fund.

Start a FundTogether we’re redefining generosity.

Join the conversation and get our newsletter.