If filing your 2023 taxes got you thinking about how to adjust—maybe even simplify—your plans for 2024, one strategy to consider is charitable tax deduction bunching. Bunching your charitable contributions can be a great help in maximizing how much you can give over the course of several years.

How does charitable deduction bunching work?

The purpose of bunching is to itemize your tax deductions in some years and take the standard deduction in other years. In some cases, this can increase your total tax deductions across multiple years.

You can bunch deductions by contributing more than one year of your planned charitable donations to a donor advised fund (DAF) in a single year. The full contribution can be eligible for a tax deduction in the year you make the donation.

Consider this example:

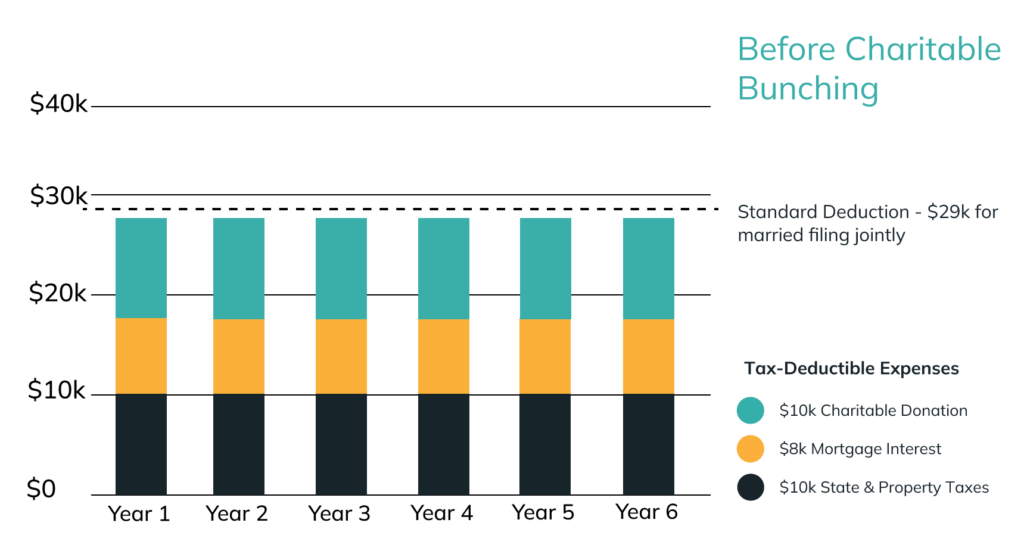

Without charitable bunching

The Jones family has the following tax-deductible expenses:

2024: $10,000 (charitable giving) + $18,000 (other Schedule A deductions) = $28,000 total deductions

2025: $10,000 (charitable giving) + $18,000 (other Schedule A deductions) = $28,000 total deductions

In this scenario, it is smarter for them not to itemize in either year because their deductions do not surpass the 2024 standard deduction ($29,200). They will take the standard deduction in 2024 and in 2025*, for a total deduction of $58,400* across both years.

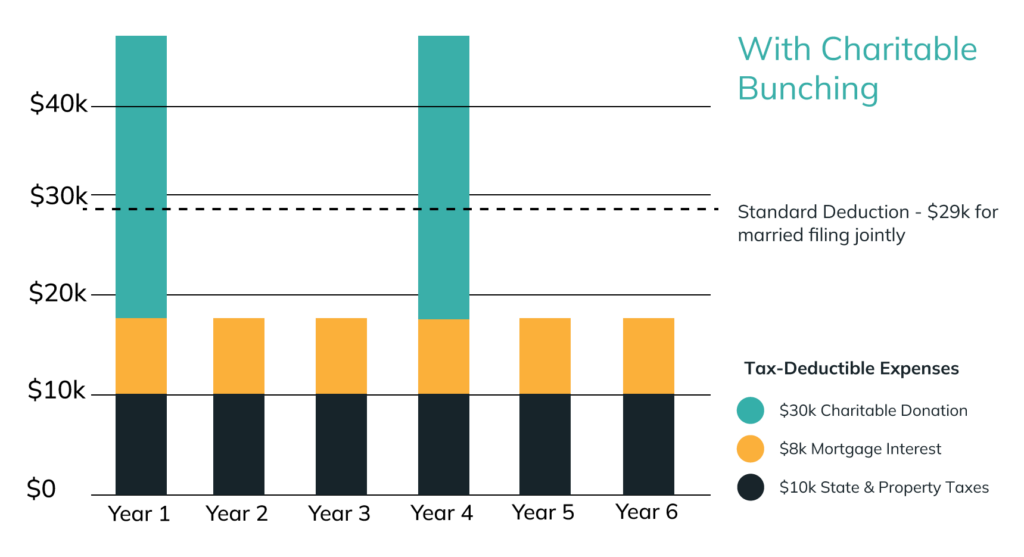

With charitable bunching

If the Jones family chooses to bunch their deductions by donating to a donor advised fund:

2024: $30,000 (charitable giving) + $18,000 (other Schedule A deductions) = $48,000 in deductions

2025: $0 (charitable giving) + $18,000 (other Schedule A deductions) = $18,000 in deductions

Here, they will itemize their 2024 tax deductions and choose to take the standard deduction in 2025, for a total deduction of $77,200* across both years.

Through the donor advised fund, the Jones family can still recommend supporting their favorite nonprofits in 2025.

Who should consider charitable bunching?

Bunching isn’t right for everyone. Charitable bunching may work for you if:

- Your deductible expenses tend to be just over or just under the standard deduction each year.

- You expect to have a lower income in the future. This may be due to expected retirement, career change, family changes, or other circumstances. Bunching deductions this year can lower your taxable income in a year when you may be subject to a higher tax rate.

- Similarly, you expect to have an unusually high income this year from a large bonus, investment gains, or other sources.

- You expect significant changes in other deductible expenses like medical expenses or state & local taxes.

Regardless of the situation, charitable bunching can help you concentrate tax deductions in certain years, such as high-income years, to minimize taxable income and maximize how generous you can be over time.

Before implementing a tax deduction bunching strategy, it’s essential to consider your overall financial situation and potential future changes in tax laws. Before making any decisions, please consult with a tax professional to determine the best approach for optimizing your planned generosity.

*The IRS has not yet announced 2025 standard deduction. In this article, we assume that the 2025 standard deduction will remain the same as the 2024 standard deduction.

Learn More about Donor Advised Funds to empower your Charitable Bunching Strategy

Discover what a donor advised is, how it works, and the potential tax benefits of using this charitable giving strategy.

How It WorksStart your journey towards a lasting legacy

Bring your family together around shared values and goals for generosity through a donor advised fund.

Start a FundTogether we’re redefining generosity.

Join the conversation and get our newsletter.